Things To Do Before You Buy A Home In Orlando

Do your homework before you buy a home. Buying a home will be one of the most important decisions that you will make in your lifetime. Most home buyers get a bit overwhelmed when they realize that they are about to be on the hook for an enormous debt for the next several decades.

In order to avoid these feelings of doubt and anxiety is to make sure that you’re buying a home that you can really afford. Here are some tips you can use that will help you to make good choices when it comes to buying a home.

Figure out how much you can afford.

As a rule of thumb, you can generally afford a home between 2 to 3 times your annual gross income. It’s important to consider all costs involved with owning a home like property taxes, homeowners insurance, HOA fees if applicable, maintenance, utilities, etc.

In addition to costs associated with the home, you must also include your own personal expenses like food, health insurance, daycare, car insurance, etc. Make sure to include everything no matter how small the expense.

What type of home suits your needs?

Wanting something and needing something are two very different things so be realistic when you’re making your home wish list. Make a list of certain things that the home must have in order to meet your family’s needs then make another list of things would like but don’t really need. This will help you to focus on the things that are truly important when shopping for a home.

If you really want granite countertops and high-end appliances and it fits your budget, then go for it. Just make sure that you’re being realistic with yourself.

Figure out where you want to live

Then decide what your second and third choice would be for the neighborhood you choose to live in. Ask your Realtor for recommendations about neighborhoods based on your priorities. Don’t settle for a neighborhood that you really don’t want to live in. You will surely regret it.

Save for the down payment

Remember when your mom and dad told you to save for a rainy day? Well look up and you’ll see the clouds starting to form. Generally, to get the best terms on a loan, you should plan on coming to the table with at least 20% of the purchase price. If you go lower than 20% then your lender will require you to get PMI [private mortgage insurance] which will add between $200 to $300 to your monthly mortgage payment.

Also, keep in mind that the less you put down, the higher your loan amount will be and the higher your payment will be. If you’re a first-time homebuyer, It’s also a good idea to see if you qualify for any state or federal programs that help with down payment assistance.

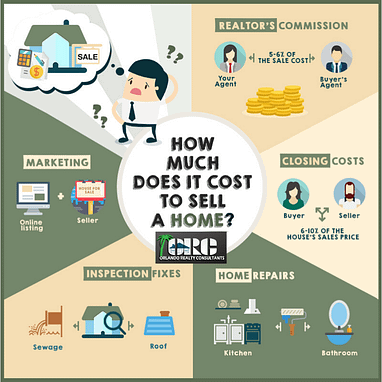

Be clear on the closing costs

Consult with your real estate agent about all the additional costs involved with a real estate transaction, especially the ones that you’ll be responsible for. Items like transfer fees, home inspections, attorney fees, etc. can add up to a substantial amount.

Consult with your realtor about negotiating the closing costs with the seller before committing to anything. Like my teacher said on the first day of real estate school…Everything in real estate is negotiable. Sometimes it comes down to the realtors involved in the transaction. If the listing agent is more experienced and a better negotiator, then chances are the buyer will get the short end of the stick.

Get pre-qualified for a loan

There’s a ton of paperwork involved with getting a loan, so be prepared. Lenders require proof of income, bank statements, w-2’s, etc. The smart move is to get pre-approved before you even start looking at homes. That way you know exactly how much you can afford to pay for a house and you’ll be ready to submit an offer right away. There’s nothing worse than finding your dream home only to find out that it’s out of your budget.