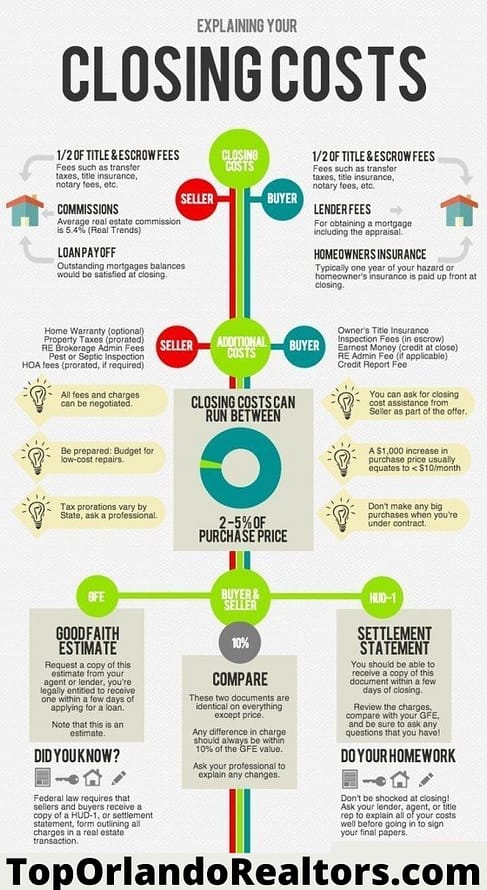

Many people tend to focus too much on sale price when trying to determine their net profits from the sale of their home. They tend to overlook the long parade of commissions, taxes, fees, and other costs that could easily add up to 7 or 8% of a home’s sale price.

Homeowners that are selling an Orlando home for the first time can be especially clueless when it comes to the smaller details of a real estate transaction. After listing your home, your Orlando real estate agent should provide you with what’s called a “Seller’s estimated net proceeds worksheet”. This will give you an idea of all the different costs that will be deducted from your net proceeds when you close.

Although certain costs can vary from state to state, these are some of the main ones you will see along with their definitions.

Mortgage Balance:

This represents any mortgages attached to the property including first and second mortgages as any home equity lines of credit. The sum of these will be your mortgage payoff balance to be deducted from your proceeds.

Mortgage Payoff Fee:

In some cases, lenders may charge an administrative fee for paying off your loan.

Release of Liens Doc:

This will appear on the title search if you’ve ever had a judgment placed on your property by a contractor, a court of law, or a property tax lien. You must pay these off before you are legally able to close. Many times certain liens can be reduced or negotiated prior to closing.

Prepayment Penalty:

Some lenders will have a prepayment clause stating that if you pay off your loan early, you will be penalized. [as if they didn’t make enough money on you already]

State Recording Fees:

Any time you pay something off as it relates to your home, it needs to be recorded with the county in order to make it official. Title companies will pay these fees and pass on the cost to you at the closing.

Real Estate Commissions:

Typically, the real estate commissions for both the buyers and sellers agents, usually 5% or 6% will be split between the listing agent’s brokerage and the buyer’s agent’s brokerage. Each agent will then get paid by their own broker.

Notary Fee:

Most documents in a real estate transaction are required to be witnessed and notarized to make sure the docs are properly executed. The fee for this will also be deducted from the homeowner’s proceeds.

Escrow Fee:

When deposits and other sums of money are received by the title company for the purpose of funding the transaction, it all gets deposited into an escrow account to make sure it gets handled properly. The escrow fee is basically a charge for the service of accepting and disbursing the money to the individuals involved in the transaction.

Title Search:

Title companies perform a title search on properties to verify who the rightful homeowners are as well as look for any liens, judgments or anything else that may keep the transaction from closing. This is usually done at the very beginning of the transaction so that homeowners will have ample time to clear up any issues that may appear well before the closing.

Seller Concessions:

A seller concession could be where the seller of the property agrees to add a three percent concession for closing costs. This concession will then be added to the sales price to help pay for the buyers closing costs.

Home Repairs:

Any repairs that the seller agreed to make as part of the deal either through negotiations with the buyer or the lender.

The Home Warranty:

A seller will sometimes agree to pay the cost of a home warranty as an incentive for the buyer. This warranty offers a certain amount of protection for the new homeowners’ first year in the home.

If you’re looking to sell your Orlando home but aren’t sure exactly how much you’ll make on the sale, call listing specialist Jenny Zamora at 407-902-7750 for a free consultation or visit us at https://orlandorealtyconsultants.com/.