Orlando real estate agents are responsible for much more than selling homes in Orlando or helping people to buy a home. Their clients rely on them to help them navigate through the entire process from beginning to end. The end being the closing of the transaction and being able to understand the breakdown of the closing costs.

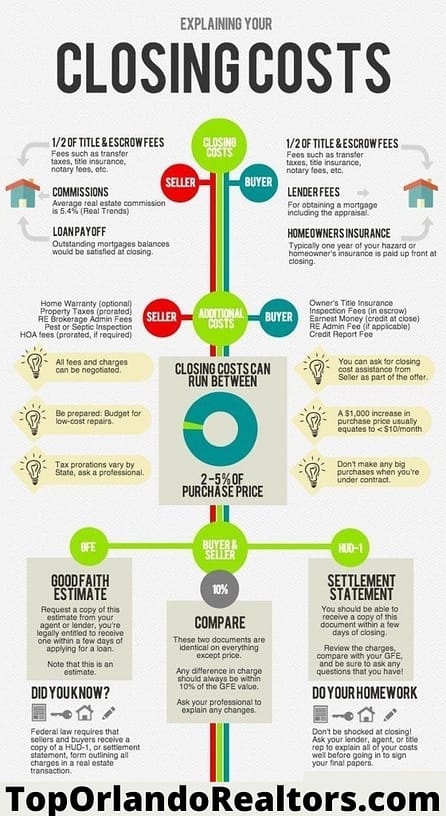

When a homeowner sells their home they typically assume that after subtracting the real estate commission and the loan payoff amount, that’s what they walk away with. Closing costs never even enter their mind, especially if it’s the seller’s first time selling a home. Then once they get to the closing table it’s a surprise to them,… not a good surprise. Typical closing costs on a real estate transaction usually include property taxes, transfer taxes, mortgage taxes, documentary taxes, recording fees, title insurance, etc.

It’s always a good idea to ask your Orlando real estate agent to provide you with a breakdown of what you can expect to pay in closing costs before you list your home for sale. You should keep this information so that when you receive an offer on your house, you can easily calculate your net profit.

Here in the state of Florida, the buyer and seller will usually share the closing costs 50/50 unless both parties agree to a different arrangement. The Orlando real estate market can also affect the way these fees are assigned. If the current market is hot, the seller will have the upper hand and can require the buyer to pay the lion’s share of the closing costs and sometimes even all of the closing costs. It’s also very common for the buyers to include all of the closing fees in their offer so that they can avoid having to come up with the cash to pay them.

The following are terms and definitions of common closing costs to be paid by the seller:

Escrow fees. In Florida it’s not required to have an attorney involved in the closing of a real estate transaction. Title companies are usually the ones to handle closings and all funds are received and disburse by the title company. The escrow fees, if any, will usually be split by both the buyer and seller.

Title Insurance. Typically there are 2 different types of title insurance that are purchased; the owner’s policy and the lenders’ policy. The title company involved in the transaction will research the title on the property to ensure that there are no additional liens on the property as well as unidentified owners. The purpose of these policies is to protect both the lender as well as the buyer [or new owner] for the full amount of the home. In most cases the buyer is responsible to pay for the lender’s policy and the seller pays for the owners policy. This is known as clearing the title.

Documentary taxes. These taxes are usually paid to the county or state or both. This is where Uncle Sam collects his share of the transaction and is also known as a reconveyance tax.

Recording fees. This fee is paid to the county for recording the deed. This is proof of ownership of the property.

Mortgage taxes. This is an additional tax which is collected by the state of Florida.

Settlement fee. Typically split between the buyer and the seller, this fee is the cost charged by the title company for handling any financial transfers.

Real estate broker’s commission. This the fee or commission that you agreed to pay for the real estate agent to sell your home. The entire amount of the realtor’s commission first goes to the brokerage before getting disbursed to your Orlando listing agent.

The pest inspection. This is usually paid for by the seller and if any pest damage is found, the seller will also have to pay for any damages caused by pests such as termites, ants, etc. Depending on whether the market favors buyers or sellers at the time, these costs are negotiated by both parties. These costs are sometimes paid for before the closing even happens and in this case, will not be part of the closing costs.

The sellers of the property are also responsible for what’s known as “recurring closing costs”. Items such as, mortgage interest on their loan, HOA fees [if applicable] and hazard insurance are all the responsibility of the seller and must be paid up through the actual date of the closing. The buyer will then be responsible for paying these same fees from the closing date forward.

Depending on what was negotiated, items like home warranties, roof repairs and any other credits that the seller agreed to pay for will also be deducted from the seller’s share of the proceeds.

Both sellers and buyers should receive a document referred to as the HUD-1 settlement statement which outlines every single charge in the real estate transaction and who is responsible to pay it.

Still have questions about a closing costs in a real estate transaction? Call me, Jenny Zamora, Orlando listing specialist at 407.902.7750