Buying a home in Florida is a dream come true for many—sunny skies and beautiful beaches. But before you get caught up in the excitement of purchasing your dream home, it’s crucial to understand the hidden costs that can catch buyers off guard. As an Orlando real estate agent, I’ve seen firsthand how these unexpected expenses can impact new homeowners. Let’s break them down so you can budget wisely and avoid surprises!

1. CDD Fees (Community Development District Fees) 📃

If you’re buying in a newer development, especially in master-planned communities around Orlando, CDD fees can be a significant cost. These fees help cover the infrastructure costs (roads, utilities, amenities) and are paid in addition to property taxes.

How Much?

- Typically $1,000 – $3,000 per year but can be higher in luxury communities.

- CDD fees last for decades and are usually built into your tax bill.

📌 Pro Tip: Always ask your real estate agent if a home has CDD fees before making an offer!

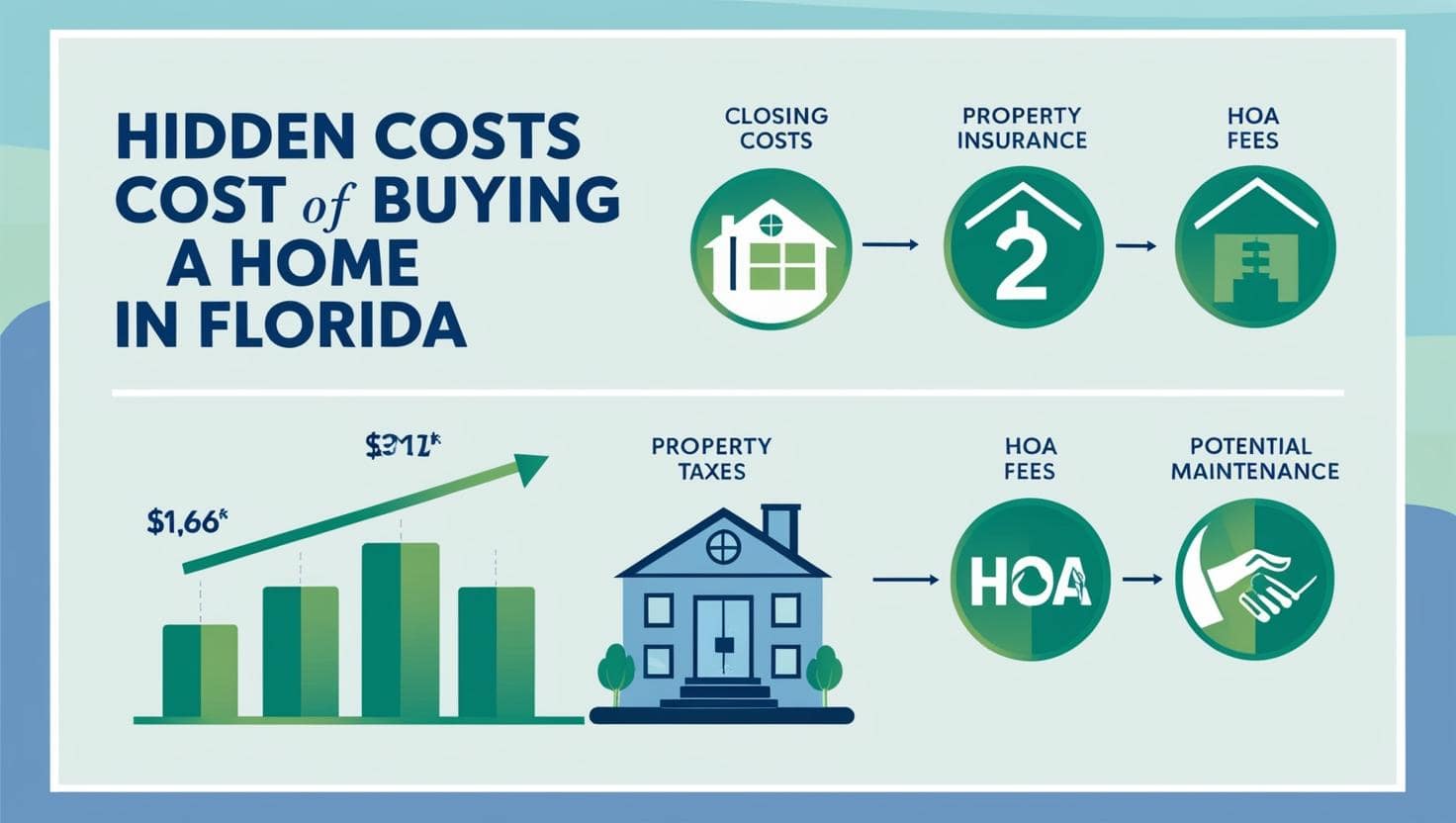

2. Homeowners Insurance in Florida is Expensive 🛡️

Florida’s extreme weather (hurricanes, flooding, and sinkholes) makes homeowners insurance more expensive compared to other states. In some coastal areas, policies are even harder to obtain!

How Much?

- Expect to pay $2,000 – $6,000 per year, depending on location and coverage.

- Flood insurance is often required, even if you’re not in a FEMA-designated flood zone, which can add $500 – $2,500 per year.

📌 Pro Tip: Get insurance quotes before you buy to avoid unexpected hikes in your monthly payment.

3. HOA Fees & Special Assessments 🏡

Many Florida communities have HOAs (Homeowners Associations) that maintain common areas, pools, and security. While HOAs can enhance a neighborhood’s appeal, they come with extra costs.

How Much?

- HOA fees can range from $50 to $600+ per month.

- Some HOAs have special assessments for big projects (e.g., roof repairs, new clubhouse renovations) that require homeowners to pay extra fees unexpectedly.

📌 Pro Tip: Read the HOA financials before purchasing to check for any upcoming assessments.

4. Closing Costs That Add Up 💸

Many buyers focus on the down payment but forget about closing costs, which typically range from 2-5% of the home’s purchase price.

Common Closing Costs in Florida:

- Title Insurance: Protects against past property ownership disputes ($1,000 – $4,000)

- Doc Stamps (Taxes): Florida charges $0.70 per $100 of the purchase price.

- Lender Fees: Loan origination, credit check, and appraisal fees ($1,500 – $5,000)

📌 Pro Tip: Ask the seller to contribute to your closing costs during negotiations!

5. Costly Home Inspections & Repairs 🛠️

A standard home inspection covers basic structural and system checks, but in Florida, additional inspections may be required:

Extra Inspections You May Need:

- Wind Mitigation Inspection: Helps reduce insurance costs ($75 – $150)

- 4-Point Inspection: Required for older homes ($100 – $200)

- Termite Inspection: Necessary in humid climates ($100 – $250)

- Mold Inspection: Can save you from expensive repairs later ($300 – $600)

If your inspection reveals roof, plumbing, or electrical issues, you may need immediate repairs before moving in.

📌 Pro Tip: Always budget at least $5,000 for post-inspection repairs, just in case!

6. Property Taxes That Surprise New Buyers 👩🏠

Florida is known for no state income tax, but property taxes can be higher than expected, especially in tourist-driven areas like Orlando.

How Much?

- Florida’s property tax rate is 0.83% on average, but taxes can be much higher depending on location.

- New homes often have artificially low tax bills in the first year (based on land value), so your tax bill could double in Year 2 when reassessed.

📌 Pro Tip: Look at the assessed value of similar homes in the neighborhood to estimate future taxes.

7. Utility Costs Are Higher Than You Think 🔋

Florida’s hot climate means you’ll run the AC most of the year, which can lead to higher electricity bills than you might be used to.

Average Utility Costs in Florida:

- Electricity: $150 – $300/month (higher in summer!)

- Water & Sewer: $50 – $150/month

- Trash & Recycling Fees: $25 – $50/month

📌 Pro Tip: Look for homes with energy-efficient upgrades to save on utilities!

8. Pest Control & Landscaping Costs 🪲🌳

Florida’s warm climate attracts bugs, rodents, and tropical weeds, which means ongoing pest control and lawn maintenance are essential.

Estimated Costs:

- Pest Control: $50 – $100/month

- Lawn Care: $100 – $300/month (if not included in HOA)

- Hurricane Prep: Tree trimming & storm-proofing can cost $500 – $1,500 annually.

📌 Pro Tip: Set aside a monthly maintenance budget to cover unexpected costs!

Final Thoughts: Be Financially Ready Before You Buy! 🚀

Buying a home in Florida is an exciting journey, but being prepared for these hidden costs will help you avoid financial stress.

Key Takeaways:

🔹 Always ask about CDD fees & HOA costs

🔹 Get homeowners insurance quotes early

🔹 Budget for closing costs & inspections

🔹 Factor in property tax increases

🔹 Plan for utility bills & maintenance costs

If you’re thinking about buying a home in Orlando or anywhere in Florida, let’s connect! I’d love to help you navigate the process smoothly. 📞 407-902-7750 🏡

Need expert advice? Call or email me today to start your Florida home search!

📧 Email: [Your Email]

📞 Phone: [Your Number]

📍 Orlando, FL Real Estate Expert