Are Orlando Short Sale properties being valued correctly?

The valuation of an Orlando short sale, as determined by the short sale lender, is probably the single most important factor of the transaction. The way it works is; we submit an offer to the bank, then the bank will order a BPO [Brokers price opinion] on the property. This person will usually be a local realtor that will go out and take photos of the property, record any damages that need repairing and after they put everything together they will complete their “BPO report” [their opinion of what the property is worth] to send to the short sale bank or the agency that hired them.

At this point there are three things that can happen that will dictate what follows.

1- The BPO comes in at a fair number that everyone is happy with and we proceed to closing.

2- The BPO comes in too low and the bank insists on another one being done. I hate when this happens because the 2nd BPO will almost always come in too high.

3- The BPO comes in so ridiculously high that the Orlando realtor has no choice but to insist that the short sale lender either order another BPO or walk away from the deal. [not on my watch]

Getting the Orlando short sale lender to order another BPO

Like an attorney presenting his case in court, it’s all about what you can prove to the lender.

Pending Listings-Pending sale homes are formerly active listings that are under contract. They have not yet closed, so they are not yet a comparable sale.

Sold Listings- These are homes that have closed within the past six months and are typically your best source for comparable sales.

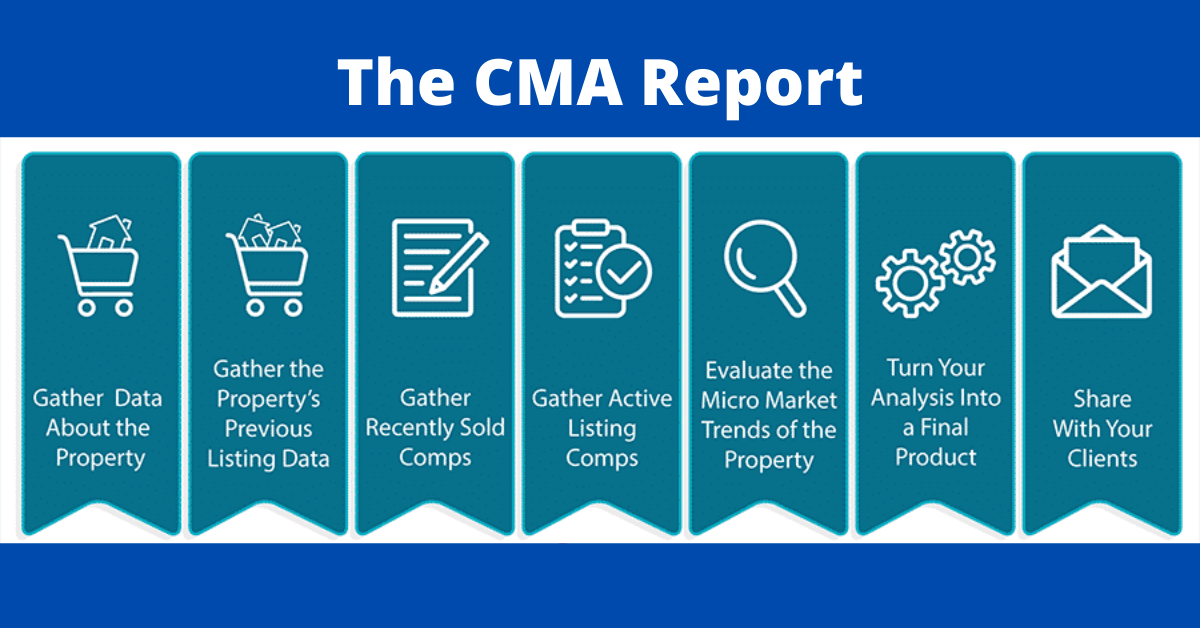

In addition to preparing a CMA for the short sale lender we provide them with a contractors estimate for repairs, lots of photos and a detailed letter explaining our case and why our offer is what it is.

Jenny Zamora, RE Broker