The pre-approval process is a huge benefit both to buyers as well as Orlando Real Estate Agents, primarily because it lets you know upfront how much you qualify for, so you don’t have to waste time looking at homes you cannot afford.

Getting Preapproved also gives is us peace of mind. I mean you now have a document in writing that states the amount of money that a lender will loan you on the house of your choosing.

Shopping for a home knowing that you’re preapproved for a mortgage is a whole different feeling than if you’re just out window shopping. Now, when you’re out looking at homes with your Orlando realtor, you know that it’s for real. When you find a home you really like, you now know that you could actually end up with it.

What Do You Need To Get Pre-Approved

The first thing you’ll want to do is actually meet with your mortgage banker or lending institution. After running a credit check on you they’ll look at your income, your assets, if you’re receiving down payment assistance from a family member, whether it’s a loan or a gift, etc. They will also want to look at your rental history because that kind of information gives them an indicator of what would happen, once you do have a mortgage.

When you approach a bank or a mortgage broker it’s best to have your paperwork ready for them. Typically they need pay stubs, bank statements, as well as the last two years of your tax returns. People that are self employed will need to provide a profit and loss statement. If you earn multiple streams of income other than your job like from a rental property for example, you should also include it.

Before pre-approving you for a mortgage, the lender will want to ensure that you don’t have a lot of outstanding debt, whether it’s student loans, or credit cards, car loans, etc.

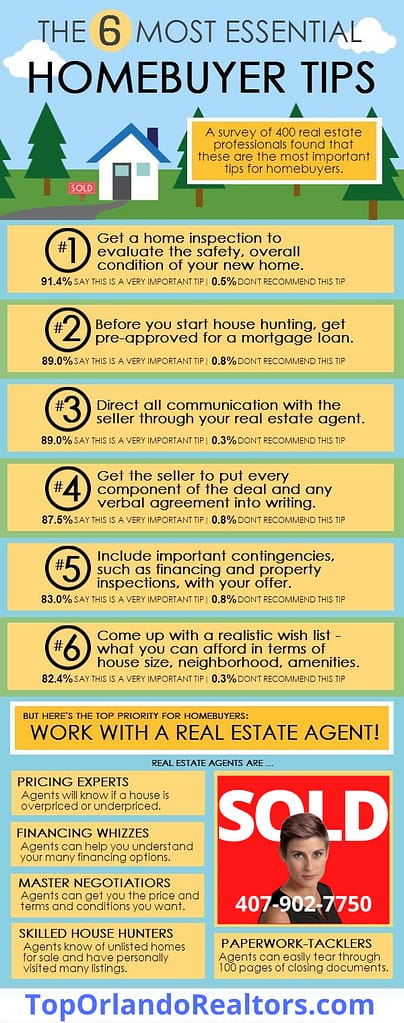

Not everyone takes the time and effort to go through the pre-approval process before going house shopping, but we definitely recommend it. The Orlando real estate market is very competitive these days so it’s best to be prepared before launching your home shopping campaign. It can be heartbreaking to find the home of your dreams, then lose it to another buyer because you weren’t prepared and they were.

When a potential buyer goes through the preapproval process it shows the listing agent for the property as well as the seller that you are a serious buyer.