Thanks to technology, buying and selling smart homes will soon be the norm for Orlando real estate agents. This week Google made a $3.2 billion dollar investment in a company called Nest Labs, a company that designs and makes smart smoke detectors and smart thermostats. It’s amazing, smart technology is becoming available in just about everything you can think of. And if it’s not today, it will be tomorrow. With an estimated $19 trillion dollar market ahead, smart technology is like a locomotive that just can’t be stopped.

How Will Increasing Smart Home Technology Affect Realtors?

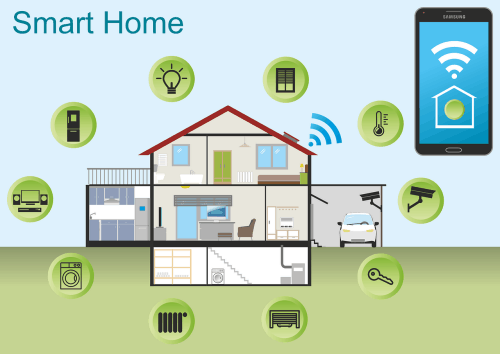

Agents that are able to embrace and love smart home technology will have the biggest advantage. The best way to do this is to learn the technology and practice using it whenever you get a chance. The way it usually works is that everything can be controlled by your smartphone through an app. You can now control things like the thermostat, window blinds, lights, locks, etc.

Real estate agents that are able to easily show their potential clients all the features of the smart technology while showing the house will have a definitive edge. Agents that are unfamiliar with the software won’t be able to show a buyer how to use it and a situation like this could possibly cost them a client.

Smart buyer’s agents will research the technology and find out what people love about it. There are many benefits that smart homeowners have like making sure the doors are locked from 800 miles away or being able to close the blinds because they forgot. Real estate agents should be able to educate their potential buyers about all the benefits that they will enjoy by living in a smart home.

Some buyers will be turned off by new technology, especially the 55+ age group. With these clients, a realtor will really have their work cut out for them in trying to sell them a smart home. The best thing to do here is to simplify things for them by making a simple guide that’s easy to use and understand. No one likes to feel less smart, especially to a house that they will be living in.

Even though I’ve only shown a handful of smart homes myself, it’s obvious that smart technology will continue to grow and get more and more popular in the world of real estate. Orlando realtors that are willing to embrace whatever comes their way, will be the most successful agents. Just like one of my very first mentors used to say ” If you’re going to make it in the world of real estate, you have to take what the market gives you”.