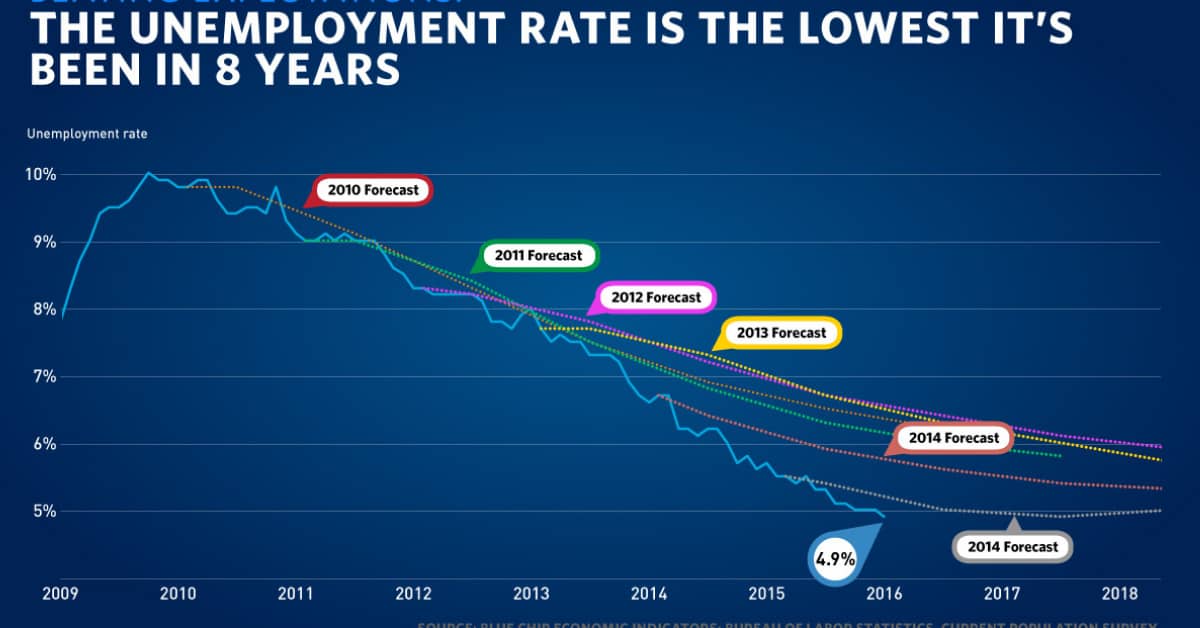

Orlando Realty sales improve partly because of less unemployment

The unemployment rate in the state Florida dropped one tenth of a percent in May. That is the lowest we’ve seen it since 2008. It makes perfect sense that this is having a positive effect on state tax collections, and Florida real estate transactions are leading the way. With less unemployment things are moving forward again. Not just in the Orlando real estate market, but across everything else the board.

Florida banks are lending money again. This not only helps people get loans to buy property, but since the beginning of 2012 financial institutions have created fifty seven hundred new jobs in Florida. In fact, Florida’s financial institutions account for 1 out of every 10 new jobs created in Florida since the first of the year.

The fact that pending sales in Florida are up thirty five percent is proof that people are back in the market ready to buy. It’s a fact that if your making enough money to pay your bills and support your family, your happy. If you’re happy you will spend more money and feel good about it, it’s just human nature. This is why the Orlando market is improving at the rate that it is. People feel like the recession is behind them and there is hope again. Fact: the #1 cause of divorce in our country is financial problems. I’m not certain but I would guess that the divorce rate in Florida overall has also dropped together with the unemployment rate.

Foreign nationals Purchasing 1 out of every 6 Orlando Properties

With Orlando Realty prices being what they were, foreign nationals are making some serious home purchases. Whether it’s for a vacation home or to move in as a primary residence to escape the cold once and for all. Orlando Real Estate is a hot commodity for people oversees. I have been working with some English investors for several years now which have purchased at least a dozen Orlando properties from us since 2008.

New Construction in Orlando Still Suffering

Although we’re seeing dramatic improvements in the Orlando real estate market lately, new construction still remains one of the hardest hit areas in Florida’s economy, losing about 20,000 jobs within the last year. Orlando Real estate Developers are going to have to come up with some even bigger incentives in order to compete with the rest of the market.

Jenny Zamora, Lic RE Broker/ Orlando Real Estate Expert