Before you apply for a mortgage to buy your dream home, check your FICO score. It is a key determinant of the interest rate that lenders are likely to offer you. A good FICO score makes you a less risky borrower in the eyes of lenders. Naturally, they’re willing to earn your business by offering you a competitive rate of interest. A lower interest rate translates into savings amounting to thousands of dollars over the life of your loan. So, pause, and think if you should improve your credit score to become a favored borrower, or go right ahead as your credit history is nothing short of impeccable. To make this decision, these tips may come in handy.

– A credit score of less than 550 makes you a deep subprime borrower; you may find it hard to get a mortgage or bear a high-interest rate and stringent and/or inflexible terms and conditions

– A credit score between 550 and 620 makes you a risky, sub-prime borrower

– A credit score between 680 and 740 makes you a less risky, prime borrower

– Any score over 740 makes you a super-prime borrower; you are highly likely to be offered the lowest mortgage rates available.

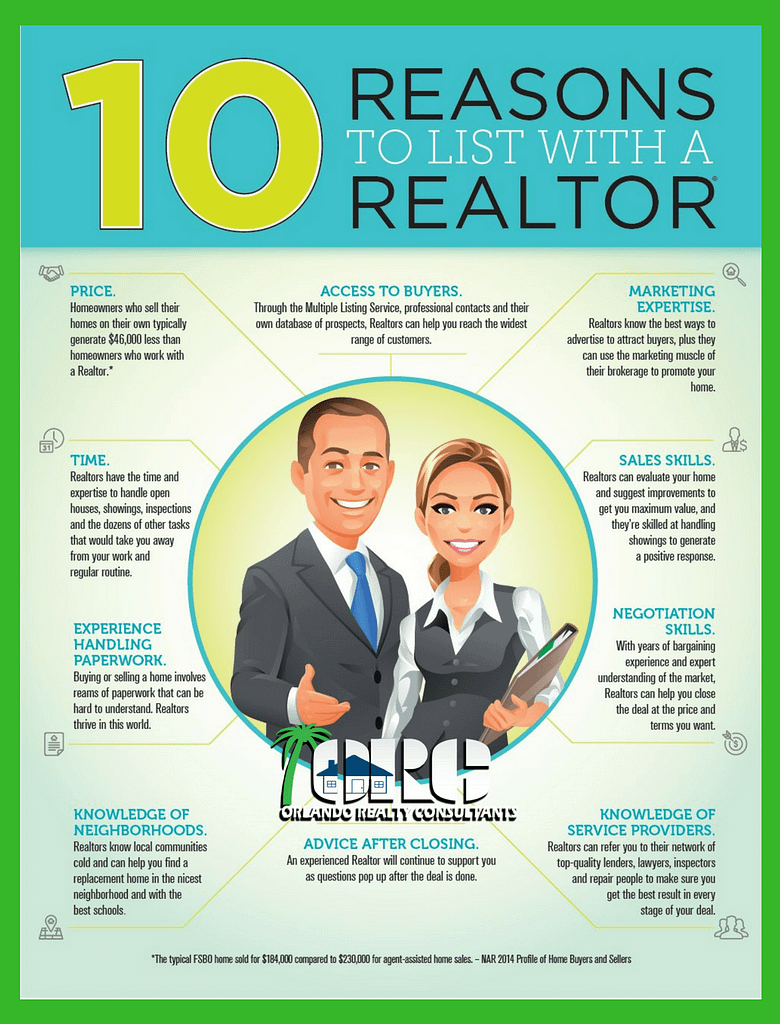

If you’re looking for a home in Orlando, Fl then you should hire an experienced Orlando Realtor to help in your search. We dedicate ourselves to helping people buy and sell Orlando, Fl real estate.