Once there is a solid offer on a property, it’s time to begin the closing process. The closing process can be explained best by breaking it down into steps.

The first step is the signing of the contract by both the buyers and sellers. This is done after both parties have agreed to all the terms of the sale including price, repairs, contingencies etc.

When both parties sign the contract, it’s then referred to as an executed contract. The next step is for the buyer to deposit a pre-determined amount of money [earnest money deposit] into an escrow account. The earnest money deposit shows that the buyer is fully committed to the transaction.

The executed contract is then sent immediately to the buyer’s lender as well as the title company so that each party can get to work on closing the transaction. Usually, there is a period of time specified in the contract [inspection period] which is used for the buyer to complete any necessary inspections of the home. This time also allows the seller to make any necessary repairs that were previously agreed upon by both the buyers and sellers.

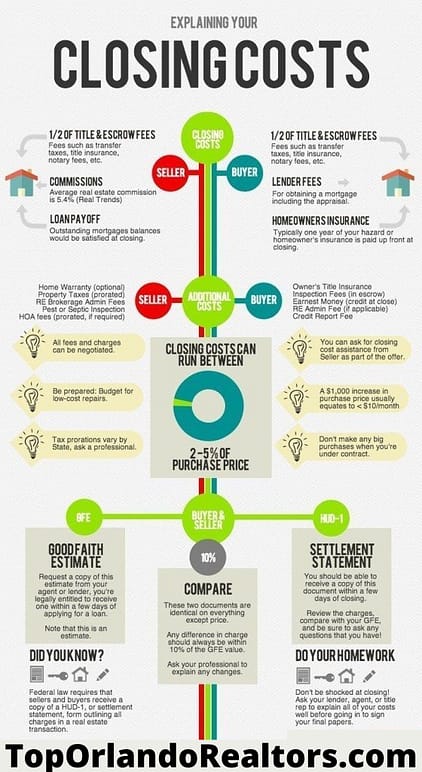

It is the realtor’s job to work together with the title company to collect all the necessary documentation. The title company then prepares a document known as a HUD-1 settlement statement. The HUD-1 is an extremely important document because it outlines all the charges associated with the sale of the home from both sides of the transaction including property taxes, commissions, outstanding HOA fees, etc.

Most importantly for the seller, it will give them a clear indication of what they will net after the sale transpires. An experienced Orlando realtor has the ability to read through the HUD -1 and quickly determine if anything is wrong and if all figures have been calculated correctly. The final step is for both parties to sign all necessary paperwork to make it official.

If you’re considering selling your home, don’t try to do it without help. Trying to buy or sell a home without the help of an experienced real estate agent could end up costing you thousands of dollars and a bunch of headaches. Contact one of our listing specialists to set up a free consultation.